Fixed Assets Management

Track all your assets from one place

Fixed Assets Management Overview

Injazat’s Fixed Assets Management package offers the following benefits:

- Catagories assets so that they can be easily accessed

- Performs monthly depreciation on all assets

- schedule preventative maintenance via various selection criteria

- Track who has custody of an asset(s) now and in the past

- Keep all asset documents in one place via the built-in document management system

- Issue assets to projects and track them online

- Get timely depreciation reports

- Print barcodes labels for all your assets

- Track warranty expiration dates for all your assets

- Get detailed maintenance reports on assets

- Get current book value for all your assets

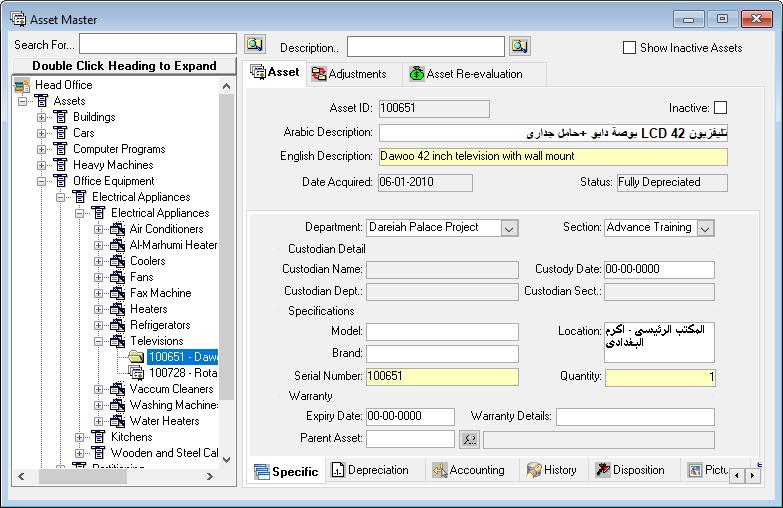

Asset Master Record

An asset has an asset number, an Arabic and English description and date of purchase. Additionally the department and section it is currently in, details of the custodian and details of the asset itself like make, model number, serial number and warranty date of expiration. In a separate tab, the previous custodians’ details will be shown particularly the from and to dates of custody.

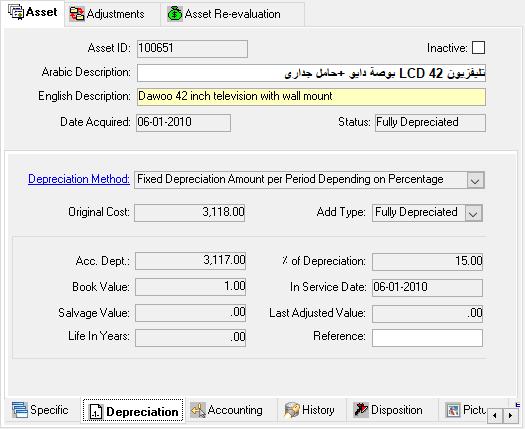

Asset Depreciation Method

The depreciation methods supported are Fixed Depreciation Amount per period Depending on Percentage, Straight Line Method, Reducing Depreciation Amount Per Period and No depreciation. Additionally, the following must be specified: Asset cost, percentage depreciation and In Sevice Date.

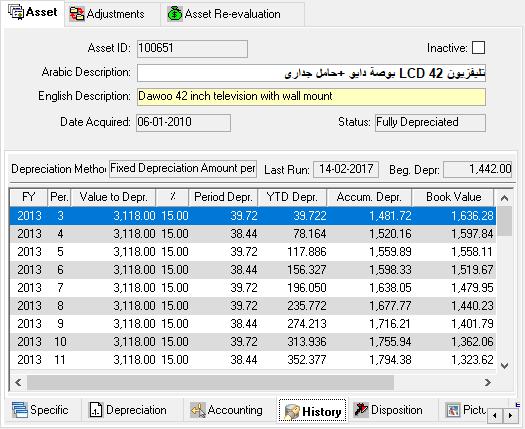

Depreciation History

This screen shows the asset’s depreciation history giving details of the month and year of depreciation, the value of the asset, the annual depreciation percentage, the period depreciation, the year to date depreciation and accumulated depreciation. Finally, it shows the current book value of the asset.

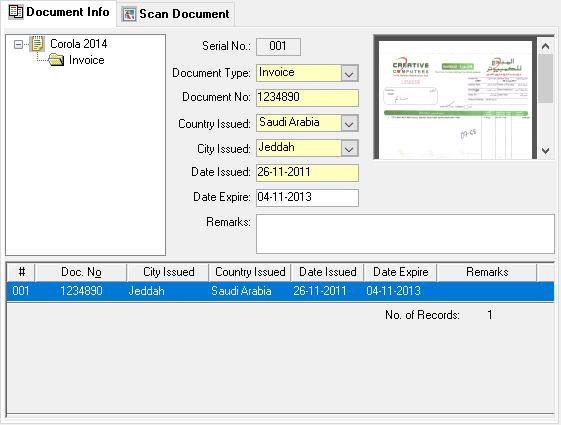

Asset Documents

The document entry screen requires a document type to be specified like an Invoice, Warranty card etc., document number, city and country of issue. Additionally, it requires the date of issue and expiry date. Remarks and pictures of the asset can be optionally added.

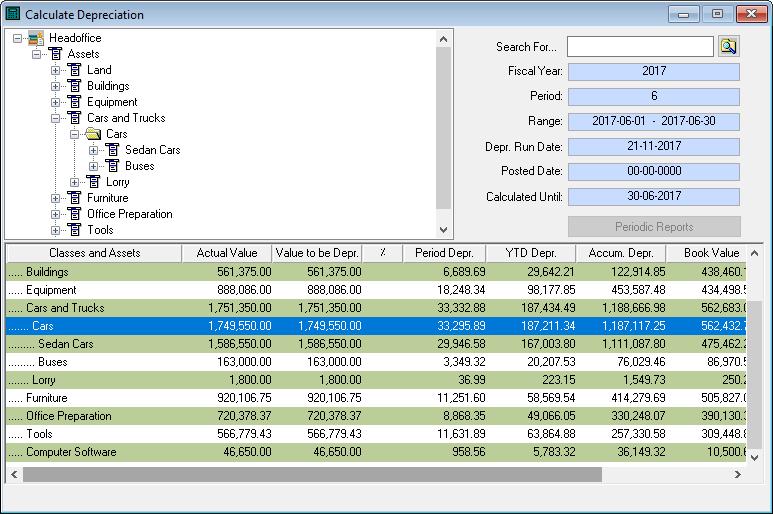

Asset Depreciation Calculation

Depreciation will be calculated for the next period due and will display the result in tree- format. Values will be displayed at asset heading level and it is possible to drill down to reach the desired asset heading or specific asset. Values displayed are for: Actual Asset Value, Period Depreciation, Year-To-Date Depreciation, Accumulated Depreciation and current Book Value.

Why Choose Us

We offer unparalleled support for all our applications. We wrote the applications to the highest standards using state-of-the-art technology and Microsoft’s flagship database management system, SQL Server. Therefore, we can offer you customization to these packages to meet your particular business needs. We are a local company who can implement these packages for you and offer continued support thereafter.